Winning the Mid-Week Market: Uncovering Investment Gems

"Risk comes from not knowing what you're doing." - Warren Buffett

Welcome!

In our adventure today, we're delving into the fascinating world of a company that's captured our attention, DANAOS CORP. We will also be sharing invaluable insights from the legendary Warren Buffett, also known as the Oracle of Omaha, and drawing inspiration from a prominent figure in value investing, Seth Klarman. Furthermore, we're diving into a seminal book every value investor should read - "You Can Be a Stock Market Genius" by Joel Greenblatt. Additionally, we will be imparting practical advice to enhance your investment strategy.

Book Review

"You Can Be a Stock Market Genius" by Joel Greenblatt

Joel Greenblatt's "You Can Be a Stock Market Genius" is a compelling guide that demystifies the complex world of investing, making it accessible to both novices and seasoned investors. The book is replete with practical advice, clear explanations, and actionable strategies that address various aspects of investing.

Key Takeaways:

Focus on Special Situations: Greenblatt emphasizes the idea of focusing on "special situations" like spin-offs, mergers, and restructurings. These events often create opportunities for outsized returns because they are typically overlooked by most investors.

Understanding Businesses: Greenblatt underscores the importance of understanding the business you're investing in. This not only means knowing the financials but also understanding the industry dynamics, competitive landscape, and management quality.

Patience and Discipline: The book advocates for a patient and disciplined approach. High returns are often the result of long-term investing and waiting for the right opportunities rather than chasing short-term gains.

Risk Management: Greenblatt emphasizes the need for effective risk management, recommending a diversified portfolio to mitigate potential losses.

Application: Greenblatt's strategies can be practically applied by investors willing to put in the time to understand special situations and by focusing on long-term value rather than short-term market fluctuations. The risk management principles he proposes can guide portfolio diversification.

Why Read this Book: This book is a must-read for anyone interested in value investing. Greenblatt, a successful hedge fund manager, shares his unique perspective and strategies that have proven successful over the years. The book does a commendable job of breaking down complex investing concepts into understandable terms. Furthermore, it presents a contrarian approach to investing, encouraging readers to look where others aren't.

Company Breakdown

Ticker: DAC

Price: $56.58

P/E Ratio: 2.09

Market Cap 1.152B

Summary:

Danaos Corporation (DAC) is a leading international owner of container ships, chartering its vessels to many of the world's largest liner companies. Danaos's fleet comprises numerous container ships of various sizes. Its primary business is to acquire and operate vessels, which it then leases to major liner companies that provide the actual cargo service.

Danaos makes money through long-term, fixed-rate time charters of its vessels. Under these charters, the charterer pays a fixed daily charter hire rate and is responsible for substantially all of the voyage expenses, including fuel costs, port charges, commissions, and marine insurance. Danaos's revenues are primarily derived from these charter hire rates.

The company's profitability depends largely on its ability to maintain high utilization rates for its vessels, manage operational costs, and navigate the cyclicality of the shipping industry. Furthermore, Danaos can also make money by buying and selling vessels at opportune times, given the cyclical and volatile nature of ship values.

The Opportunity

Danaos Corporation is a charterer of container vessels to liner companies, trading at 0.48x NAV and 3x EV/EBIT.

The company has the potential to earn its current market cap in cash over the next two years.

A projected total return of 2.5x money back (38% IRR) for investors at current prices by end-2025.

Danaos's revenue is already 2/3rds contracted to 2025, providing a steady cash flow.

The company's fleet consists of 69 vessels with an average contract length of 25 months.

Despite being in its best financial health ever, Danaos is currently valued at near a 15-year low in terms of its enterprise value.

Danaos is not directly exposed to freight spot rates, earning through long-term contracts with liner companies.

The two main risks for investment are the rates on vessels coming off contract in coming years and capital allocation decisions made by management.

Danaos provides vessel-by-vessel rates and contract terms, allowing for easy projections.

Despite being a capital-intensive business with exposure to volatile daily charter rates, the company is viewed as a low-risk investment due to its NAV underpin and low debt.

The company's customer base is considered reliable and credit-worthy.

Danaos's major customers include first-class names in the industry, providing a level of security for the investment.

Read More Here

Credit to FuzzyLogic

Investor Spotlight

Seth Klarman is a highly respected value investor and founder of the Baupost Group, a Boston-based private investment partnership. Known for his patient and disciplined approach, Klarman has consistently achieved strong results for his firm. He is also the author of "Margin of Safety," a seminal book on value investing. Klarman's investment philosophy emphasizes risk-averse value investing, with a focus on buying securities at a significant discount to their intrinsic value and patiently waiting for their price to converge with their worth.

Investing Tips

One of Seth Klarman's most notable investing tips is the concept of "margin of safety," which is also the title of his book. The idea is to always invest with a safety margin to guard against loss and uncertainty. This means buying securities at a significant discount to their intrinsic value, providing a cushion against errors in analysis or unforeseen issues that may lower the asset's value. Klarman believes that by focusing more on risk than on potential profits, investors can protect themselves from severe financial losses.

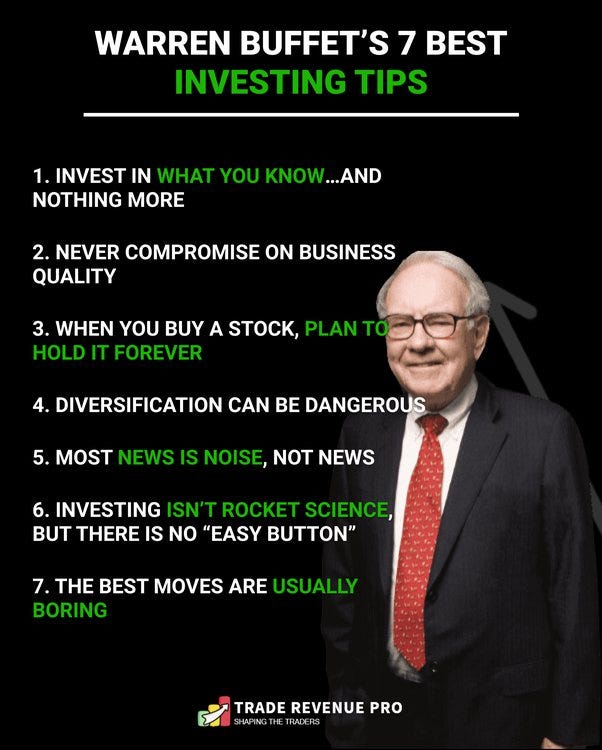

Warren Buffett Wisdom

We always value your thoughts, questions, and feedback. Your insights help us create content that best serves your needs and interests. Please don't hesitate to reach out to us with any comments, questions, or even topics you'd like to see covered in future editions of our newsletter.

We are committed to providing you with relevant and insightful content, and your input is invaluable in helping us achieve this goal. Remember, there's no such thing as a silly question, and your feedback is always appreciated.

If you know someone - be it a friend, family member, or colleague - who might benefit from our newsletter, we encourage you to share it with them. Our goal is to create a community of informed and engaged investors, and every new reader helps us to do just that.

Thank you for your ongoing support and involvement. Your engagement is what makes this community so unique and valuable!

Best regards,

Value Vultures