Value Vultures Thursday Edition

"In the business world, the rearview mirror is always clearer than the windshield." - Warren Buffett

In this edition of Value Vultures, we're excited to bring you:

Book Summary: We're diving into the timeless classic, "The Little Book of Value Investing" by Christopher H. Browne. Whether you're new to investing or a seasoned pro, we'll highlight the key takeaways that can shape your investing philosophy and approach.

Investor Spotlight: This week, we shine the spotlight on Joel Greenblatt, a renowned value investor known for his "magic formula" investing strategy. We'll explore his philosophy, success story, and key lessons that you can apply to your own investing journey.

Company Breakdown: We take a detailed look at Green Plains Inc. (GPRE)., an overlooked gem.

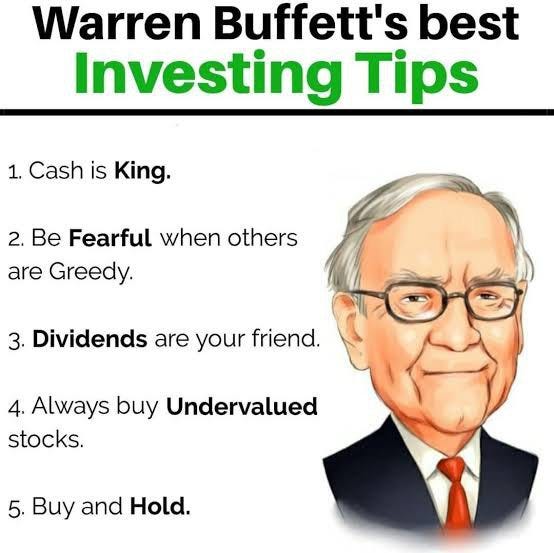

Buffett's Wisdom: In our ongoing exploration of Warren Buffett's insights, we share and explain one of his lesser-known but highly insightful quotes about value investing. Learn how the Oracle of Omaha views the market and how his philosophy can help guide your investment decisions.

Remember, investing isn't just about numbers and balance sheets - it's about a mindset. We hope our insights help you hone your investing mindset and strategies. Let's dive in!

Book Review

"The Little Book of Value Investing" by Christopher H. Browne

"The Little Book of Value Investing" by Christopher H. Browne is a concise, accessible guide that offers a wealth of knowledge for anyone interested in value investing. Browne distills complex investing principles into easy-to-understand lessons, making it a must-read for both new and seasoned investors.

Key Takeaways:

Buy Stocks Like Groceries, Not Perfume: Browne advises treating stock purchases like buying groceries - aim for good value at a reasonable price, not overpriced luxury items.

The Margin of Safety: Echoing Benjamin Graham's philosophy, Browne highlights the importance of investing in companies with a significant margin of safety – essentially, a buffer between the price you pay and the company's intrinsic value.

The Importance of Dividends: Browne stresses the role of dividends in total return and advocates for investing in companies that consistently pay and increase dividends.

Patience is a Virtue: Value investing isn't about quick wins; it requires patience to wait for undervalued companies to reach their true potential.

Why It's Worth Reading:

Browne's book is a straightforward, practical guide to the principles of value investing. It offers valuable insights without getting lost in financial jargon, making it an excellent resource for anyone looking to delve into the world of value investing. While it doesn't promise a quick path to riches, "The Little Book of Value Investing" provides a roadmap for long-term investment success based on tried and true principles.

Company Breakdown

Ticker: Green Plains Inc. (GPRE)

Price: $31.59

P/E Ratio: Negative Earnings

Market Cap 1.88B

Summary:

Green Plains Inc. is a leading biorefining company based in Omaha, Nebraska, that focuses on producing low-carbon biofuels and high-protein feed ingredients.

The company operates through two primary segments:

Biofuels: Green Plains is one of the largest ethanol producers in the world, with 13 biorefineries across the U.S. They transform a variety of feedstocks into renewable biofuels, which are used in transportation fuels.

Agribusiness and Energy Services: In addition to biofuels, the company produces high-protein animal feed and corn oil, both derived from the ethanol production process. These by-products are sold to local and global markets, contributing to the company's revenue.

Green Plains makes money primarily by processing feedstock into ethanol and selling it to various industries, most notably the transportation sector. Their agribusiness and energy services segment also generates revenue by selling by-products of the biofuel production process. The company's success depends on feedstock prices, demand for ethanol and other biofuels, and regulatory changes in the energy sector.

Green Plains is also investing in high-protein technology to further increase the value of their by-products and enhance profitability.

The Opportunity

GPRE was primarily an ethanol producer with 11 ethanol plants across the Midwest and Central United States, capable of producing ~1 billion gallons of ethanol.

Faced with industry volatility, GPRE decided to diversify into a bio-refinery focusing on agricultural co-products like high protein feed ingredients, enhanced corn oil production, and clean sugar.

Acquisition of Fluid Quip Technologies in January 2020 marked the start of this transformation. Fluid Quip brought a portfolio of competitive AgTech IP focusing on high protein feed ingredients, increased corn oil yield, and clean sugar production.

High Protein: Fluid Quip's technology enhances GPRE’s dried distillers grains into a high protein feed ingredient. GPRE anticipates producing ~600k tons of high protein feed ingredients.

Corn Oil: Fluid Quip’s IP enhances GPRE's corn oil yield by ~50%. GPRE anticipates producing ~400 million pounds of corn oil.

Clean Sugar: GPRE is building its first clean sugar facility at its Shenandoah plant with a capacity of up to 200 million pounds.

These co-products provide better financial performance than GPRE’s historical legacy ethanol production.

GPRE has spent the past 24 months rolling out these enhancements to half of its facilities. The remaining half are scheduled to be converted over the next ~18 months.

Despite progress, market volatility and weak ethanol environment masked GPRE's transformation in 2022. It is expected that the market will appreciate the improvement in GPRE's financial performance during 2023.

Base case estimate for GPRE is ~$60-$65 as the transformation is completed with several upside opportunities including benefits from the recent Inflation Reduction Act, GPRE’s carbon sequestration opportunity, and the sustainable aviation fuel opportunity.

Activist investor Ancora issued a public letter pushing the board to explore fair value in the market by hiring a banker and initiating a strategic review process. They estimate strategic acquirers could pay $50 or more to acquire Green Plains.

There are multiple ways to win with an investment in GPRE at current levels including a rerating as transformation is completed, an offtake agreement for corn oil production, or sale of the entire company.

GPRE is trading at less than 5x year-end 2023 run-rate EBITDA ~$450 million which ascribes no value to GPRE’s legacy ethanol production.

GPRE's balance sheet is also in great shape with $500mm of cash.

Read more Here

Credit to dman976

Investor Spotlight

Joel Greenblatt is a highly respected value investor, author, and academic. He is known for his unique and effective "Magic Formula" investing strategy, which combines high return on capital and high earnings yield.

Greenblatt founded Gotham Capital, a private investment partnership, which generated extraordinary returns under his management. He is also the author of bestsellers like "The Little Book That Beats the Market" and "You Can Be a Stock Market Genius."

Additionally, he teaches as an adjunct professor at Columbia University's Graduate School of Business, passing on his insights to the next generation of investors.

Investing Tips

One of Joel Greenblatt's key investing tips is about patience and long-term investment.

He emphasizes the importance of buying good businesses at bargain prices and then holding onto them for the long term.

Greenblatt often advises against trying to time the market, suggesting that investors should instead focus on the fundamental qualities of the businesses they're investing in.

As he wrote in "The Little Book That Beats the Market,"

"If you just stick to buying good companies (ones that have a high return on capital) and to buying those companies only at bargain prices (at prices that give you a high earnings yield), you can end up systematically buying many of the good companies that crazy Mr. Market has decided to literally give away."

Warren Buffett Wisdom

We always value your thoughts, questions, and feedback. Your insights help us create content that best serves your needs and interests. Please don't hesitate to reach out to us with any comments, questions, or even topics you'd like to see covered in future editions of our newsletter.

We are committed to providing you with relevant and insightful content, and your input is invaluable in helping us achieve this goal. Remember, there's no such thing as a silly question, and your feedback is always appreciated.

If you know someone - be it a friend, family member, or colleague - who might benefit from our newsletter, we encourage you to share it with them. Our goal is to create a community of informed and engaged investors, and every new reader helps us to do just that.

Thank you for your ongoing support and involvement. Your engagement is what makes this community so unique and valuable!

Best regards,

Value Vultures