Value Investing: Get Rich Slowly But Surely

"It's far better to buy a wonderful company at a fair price, than a fair company at a wonderful price." - Warren Buffett

They say the stock market is unpredictable.

But what if I told you that's just not true? What if I said that you can consistently beat the market through tried-and-true principles of value investing?

Principles pioneered by legends like Warren Buffet and Benjamin Graham that are rarely understood and applied correctly.

Principles that I've used time and again to uncover hidden gem stocks primed to outperform. Stocks flying under Wall Street's radar that I've used to generate 20%, 30%, even 50%+ returns.

Stocks from little-known and under-appreciated companies with rock-solid fundamentals trading at deep discounts to their intrinsic values.

How is this possible in an efficient stock market you ask?

The best investments are often where no one else is looking. Join me each month to discover the most promising and overlooked value stocks - everything you need to steadily build wealth over any market cycle.

Ready to start adding true value to your portfolio? Dive in! Todays Value

Book Review : The Dhandho Investor

Why Doesn’t Warren Like Retailers

Video : Warren Buffett On Retailers

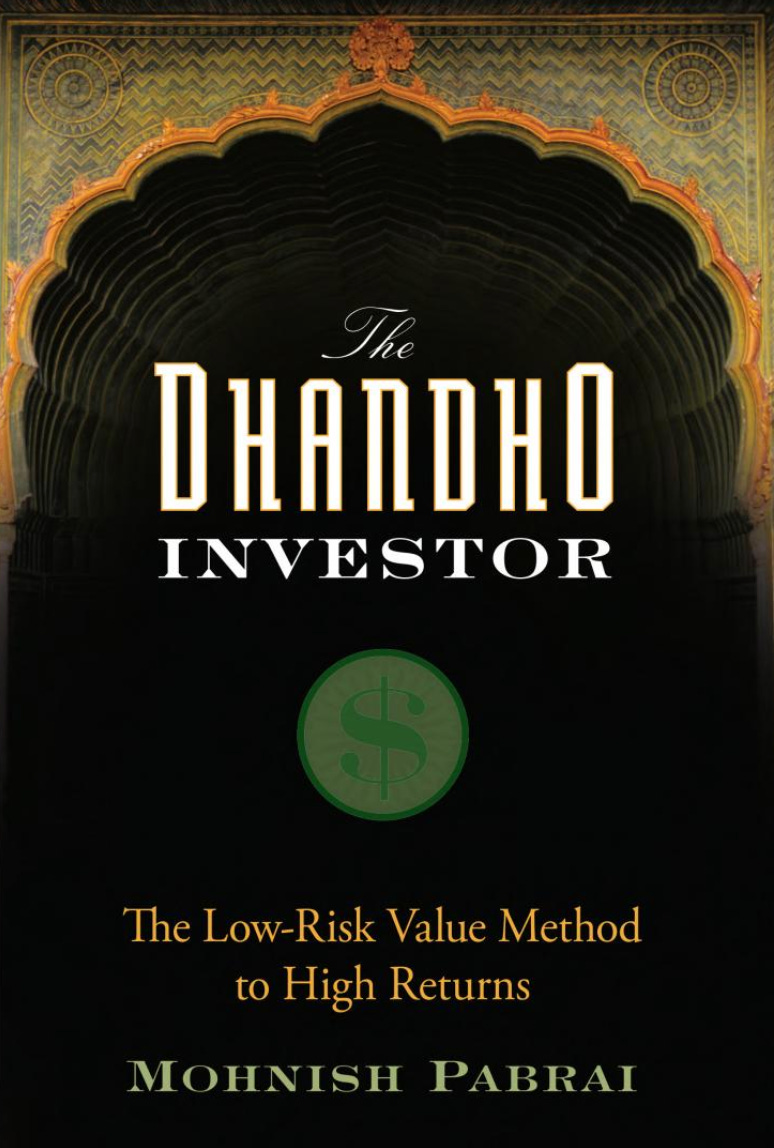

Book Review

The Dhandho Investor: The Low-Risk Value Method to High Returns

The Dhandho capital allocation framework is inspired by the success of ultra-profitable immigrant-run businesses. "Dhandho" refers to investing in existing ventures with asymmetric returns - huge upside potential with minimal downside risk. It focuses more on minimizing losses than maximizing gains.

Core Principles of Dhandho Investing

Invest in simple, predictable existing businesses rather than risky startups

Seek a few bets with large payoffs rather than numerous small bets

Limit capital at risk by investing only what one can afford to lose

Know when to sell; don't become emotionally tied to investments

How to Find Dhandho Investments: To find investments that fit the Dhandho criteria, look for profitable, cash flow positive companies showing signs of distress rather than steady growth. Exploit lags in information and lack of Wall Street attention.

Conclusion - Dhandho Gives Small Investors an Edge The Dhandho framework allows small investors to invest like the pros and realize market-beating returns. By following the principles to assess asymmetric risk/reward scenarios, individual investors can develop an edge over traditional institutions focused mostly on chasing growth.

The book clearly outlines this distinct low-risk value investing approach using real-world illustrations of the framework in practice. The main takeaway is learning to evaluate potential returns while keeping capital at risk to a minimum.

Why Doesn’t Warren Like Retailers

Warren Buffett, the legendary investor behind Berkshire Hathaway, is known for his penchant for companies with durable competitive advantages and predictable earning power over time. Retailers, with their reliance on shifting consumer preferences and intense competition, tend to not fit his investing criteria.

For one, retailers face significant disruption risk today from ecommerce and new technologies. Brick-and-mortar stores must contend with giants like Amazon constantly threatening their business models, making it hard to predict their long-term prospects. Even those benefiting from hot trends face an uncertain future the moment consumer tastes change.

Additionally, retailers operate on thin profit margins that leave little room for error. Rising labor, real estate, transportation, and inventory costs can quickly eat into earnings. This inherent uncertainty around future profits makes most retailers less appealing to a value investor like Buffett seeking safety of principal.

Buffett prefers to put his money into companies that can be easily understood, have loyal customers, pricing power, and strong managers. Brands that checkout customers flock to decade after decade. Unfortunately most retailers fail this test, facing fickle demand and the constant need to discount or reinvent themselves to stay relevant.

Of course, just because Buffett typically stays away from retailers doesn't mean there aren't exceptions. He has invested in certain retailers before, including The Furniture Mart and Nebraska Furniture Mart. But when he does, you can bet it's a retailer protected by a wide moat keeping competition at bay. That's the only kind of retail bet Buffett is ever likely to make.

Warren Buffett On Retailers

We always value your thoughts, questions, and feedback on the content provided. Please don't hesitate to reach out with any comments, questions, or topics you'd like to see covered in future editions of our newsletter.

We are committed to providing you with relevant and insightful content, and your input is invaluable in helping us achieve this goal.

If you know someone - be it a friend, family member, or colleague - who might benefit from our newsletter, we encourage you to share it with them. Our goal is to create a community of informed and engaged investors, and every new reader helps us to do just that.

Thank you for your ongoing support and involvement. Your engagement is what makes this community so unique and valuable!

Best regards,

Value Vultures