Unlock Hidden Treasures: Value Vultures Reveals Top Undervalued Stocks

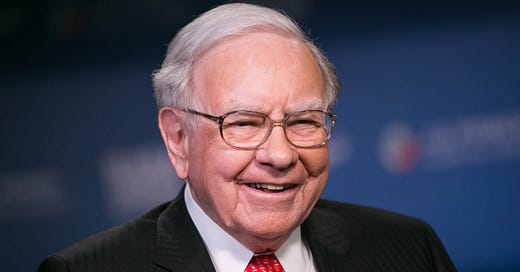

"Price is what you pay. Value is what you get." - Warren Buffett

Welcome!

5/14/2023 - Sunday

Hello, and Welcome to Value Vultures!

In todays journey, we're dissecting an intriguing company that's piqued our interest, sharing timeless wisdom from the Oracle of Omaha, Warren Buffett, and gleaning lessons from a notable value investor. Moreover, we're exploring a must-read book for every value investor and sharing practical tips to refine your investing strategy.

Book Review

"The Intelligent Investor" by Benjamin Graham

"The Intelligent Investor" by Benjamin Graham is not just a book; it's a seminal piece of financial literature that has shaped the world of investing as we know it today. For any individual seeking to delve into value investing, this book is often the first recommended read.

First published in 1949, the book has stood the test of time, with its principles remaining as relevant today as they were more than seven decades ago. Graham's work focuses on the mindset of the investor, advocating for a thorough, disciplined, and patient approach to investing.

Key Takeaways:

Margin of Safety: Perhaps one of the most important concepts introduced by Graham, the "margin of safety" principle suggests that one should only invest in a stock when it is priced significantly below its intrinsic value. This provides a buffer in case the investment doesn't pan out as expected.

Mr. Market: Graham's allegory of "Mr. Market" serves as a timeless reminder that the market can be irrational in the short term. Investors should see market fluctuations as opportunities rather than guides.

Defensive vs Enterprising Investing: Graham distinguishes between defensive (passive) investors, who aim for steady returns with minimal effort, and enterprising (active) investors, who are willing to take on more work for potentially higher returns. The book provides strategies for both types of investors.

Fundamental Analysis: Graham emphasizes the importance of analyzing the fundamentals of a company, such as its financial statements, rather than speculating on market trends.

Why It's Worth Reading:

"The Intelligent Investor" is a comprehensive guide for anyone who wants to understand the fundamentals of investing. Its lessons are not just about how to invest but also about how to think about investing. Graham's rational approach to investing provides a counterpoint to the speculative mindset often seen in today's fast-paced investment world.

Whether you're new to investing or an experienced investor, "The Intelligent Investor" offers valuable insights that can help you make more informed investment decisions. Remember, as Graham states, "Investment is most intelligent when it is most businesslike." This book will certainly equip you to approach investing in a more businesslike and intelligent manner.

Company Breakdown

Ticker: AVTR

Price: $20

P/E Ratio: 22.49

EV/EBITDA: 13.4

Current Ratio: 1.57

ROA: 4.57%

Summary:

Avantor, Inc. is a global provider of mission-critical products and services to customers in the life sciences and advanced technologies & applied materials industries. They provide products and services in three main categories:

Materials & Consumables: Avantor sells a wide range of essential products including chemicals, reagents, consumables, durable lab equipment, and supplies. These are used in pharmaceutical and biopharma production, laboratory research, and other high-tech industries.

Equipment & Instrumentation: Avantor sells and services critical equipment and instrumentation used by their customers in scientific research, patient diagnostic services, and manufacturing processes.

Services & Specialty Procurement: Avantor offers a range of services including procurement and sourcing, logistics and supply chain, business process consulting, technical services, and on-site services to help their customers manage their supply chain effectively.

Avantor makes money by selling these products and services to customers in industries ranging from pharmaceuticals and biotech to semiconductors and aerospace. The company serves both large multinational corporations and smaller research and development companies.

Their revenue model is a mix of transactional sales and long-term contracts. The percentage split of revenues between these categories can vary year by year, depending on market conditions, customer demands, and strategic decisions by the company.

Avantor, Inc. (AVTR) is an appealing investment opportunity with potential for over 30% growth. This is due to several factors including resolving issues that previously hindered the company, an attractive valuation of the stock, a decreasing leverage profile, and a growing pipeline for mergers and acquisitions.

Avantor is a global provider of vital products and services to industries including biopharma, healthcare, education & government, and advanced technologies & applied materials. It has a broad customer base, no single customer makes up more than 4% of net sales, and about 85% of its revenue is generated from recurring products and services.

Avantor's business has seen significant changes, including the lifting of private equity overhang, and the completion of several acquisitions (Masterflex, Ritter GmbH, and RIM Bio). These changes, along with stable industry growth, make the company's stock attractive for investment.

However, Avantor has experienced some issues which affected its earnings. These include lower-than-expected contributions from mergers and acquisitions, supply chain issues, impact from Covid lockdowns in China, and softening trends in European industrial demand. Despite these, the company's fundamental attributes remain solid and present a promising investment opportunity.

As of the time of the post, the stock is trading at around $24, which is a recovery from a low of ~$18 in October.

An in-depth analysis of a specific company. Evaluate its financial health, management, competitive position, and potential for long-term growth. Determine whether it's currently undervalued.

The Opportunity

Abating Fundamental Headwinds: After overcoming several challenges in 2022, Avantor (AVTR) is expected to return to steady growth by the second half of 2023, which will drive better margins and greater Free Cash Flow (FCF) generation.

Attractive Valuation: Despite having above-average growth prospects and a below-average risk profile, AVTR's stock is trading at a lower price-to-earnings ratio than the S&P 500 Index, and significantly lower than its peer group. This indicates that AVTR is undervalued, providing an attractive investment opportunity.

Declining Leverage: Avantor has successfully reduced its net leverage from 4.2x at the end of FY2021 to 3.7x at the end of FY2022, falling within its target range of 2.0-4.0x. The company plans to continue reducing its leverage throughout 2023, which will increase the value of its equity.

Inorganic Growth Opportunities: While the company's near-term focus is on continued deleveraging, Avantor's management is also building a pipeline of M&A opportunities. Given its reduced leverage, the company has the financial flexibility to pursue these opportunities, which would potentially boost the stock value.

Risk Reward

In a Base Case scenario with AVTR generating $1.60 in 2024 EPS and a PE valuation multiple of 20.0x, the stock could rise to $32, providing over 30% upside from current levels.

A Downside Case scenario, with AVTR earning $1.40 in 2024 EPS and a reduced 15.0x PE multiple, could see the stock fall to $21, marking a 12.5% decrease from current levels.

In an Upside Scenario, AVTR could generate $1.80 in 2024 EPS and trade at a 23.0x PE multiple. This could result in the stock reaching $41, a more than 70% increase from current levels.

Given these scenarios, AVTR's risk/reward profile seems skewed positively towards the upside.

-https://valueinvestorsclub.com/idea/AVANTOR_INC/2963681633

by quads1025

Investor Spotlight

Warren Buffett is one of the most successful value investors in the world, known for his shrewd investment decisions and his adherence to the principles of value investing.

Strategies

Buffett's investing strategy is built upon the principles of Benjamin Graham, the father of value investing. His primary rule is to never lose money, and his second rule is to never forget the first rule. He adheres to the principles of buying undervalued, stable companies and holding them for the long term.

He's a proponent of fundamental analysis, evaluating companies based on their intrinsic value rather than market trends or cycles. He looks for companies with a competitive advantage or 'economic moat', strong management, and predictable earnings. Additionally, he prefers businesses that he understands and avoids overly complex investments.

Notable Investments

One of Buffett's most notable investments is Berkshire Hathaway itself, a textile company he initially bought due to its undervalued assets. Over time, he shifted the business towards insurance and investing, and it became a holding company for his other investments.

Buffett's other significant investments include Coca-Cola, American Express, and Wells Fargo. He invested in these companies because they had strong brands, predictable earnings, and were undervalued at the time of purchase.

Lessons to Learn

Patience: Buffett is a long-term investor who is willing to wait for the right opportunity to invest. He doesn't try to time the market, and he's not afraid to hold cash until he finds the right investment.

Invest in What You Understand: He only invests in companies he understands thoroughly. This principle helps him avoid investments that are outside his area of expertise and reduces his risk.

Look for Intrinsic Value: Buffett doesn't follow trends or fads. Instead, he looks for companies that are undervalued based on their intrinsic worth.

Margin of Safety: Buffett always looks for a margin of safety in his investments. This means he aims to buy companies for less than their intrinsic value to protect himself against unexpected events or miscalculations.

Management Matters: Buffett believes in investing in companies with honest and competent management. He understands that the quality of the management team can significantly affect the performance of the company.

The Power of Compounding: Buffett has demonstrated the power of compounding returns over the long term. His strategy of buy-and-hold has resulted in substantial growth of his investments over time.

Investing Tips

A significant investing tip is "Invest for the long term."

Why is it important?

Benefit from Compounding: The longer you keep your money invested, the more time it has to grow. The concept of compounding means you not only earn a return on your initial investment (the principal), but over time, you also earn a return on the money your investment has already made. This can dramatically increase your wealth over long periods.

Warren Buffett Wisdom

We always value your thoughts, questions, and feedback. Your insights help us create content that best serves your needs and interests. Please don't hesitate to reach out to us with any comments, questions, or even topics you'd like to see covered in future editions of our newsletter.

We are committed to providing you with relevant and insightful content, and your input is invaluable in helping us achieve this goal. Remember, there's no such thing as a silly question, and your feedback is always appreciated.

If you know someone - be it a friend, family member, or colleague - who might benefit from our newsletter, we encourage you to share it with them. Our goal is to create a community of informed and engaged investors, and every new reader helps us to do just that.

Thank you for your ongoing support and involvement. Your engagement is what makes this community so unique and valuable!

Best regards,

Value Vultures