SBUX | 52 Week Low | Time to Buy?

"The stock market is designed to transfer money from the Active to the Patient." - Warren Buffett

The siren call sounds. Starbucks stock has sunk to depths not seen in over a year, leaving investors wondering if there are discounts to be had or storms ahead.

With sales flagging but brand power still robust, is the coffee giant poised for a rebound or headed for further trouble as consumers and companies tighten belts?

We dive into the numbers behind the napkins.

Table of Contents

The business

Revenue

DCF/FreeCash Flow

Comparables

ROIC

The Business | SBUX

Serving Up Wake-Up Jolts for Over 50 Years and Counting

From its first humble shop in Seattle's Pike Place Market over 50 years ago, Starbucks has grown to become an indispensable supply line for caffeine and tasty treats across over 30,000 locations globally. But it hasn't always been smooth sailing for the world's largest coffeehouse chain, especially amid a pandemic.

With a new CEO at the helm in Howard Schultz, Starbucks aims to regain its mojo by boosting worker benefits and morale while fending off resurgent unionization efforts. At the same time, it strives to be the third place between home and work for millions and adapt its menu to changing consumer tastes and health trends.

Even as sales rebound post-lockdowns, can Starbucks rediscover the secret ingredients that made it a household name? We explore the company's ups and downs and whether it still packs the punch to energize your portfolio.

Revenue

Starbucks Brews Up Steady Revenue Growth in 2022

Total net revenues climbed 12% or $3.7 billion. Growth largely driven by more sales from company-operated stores.

Company-operated store revenues rose on an 8% jump in comparable sales per store, thanks to higher average spending along with more customer visits.

Opening 1,339 net new company-run stores over the past year also boosted company revenues.

Licensed stores revenues grew as well, fueled by more sales of Starbucks products and equipment to licensees along with more royalty income.

Other areas declined slightly, impacted by the 2021 sale of Evolution Fresh juices. Revenue from the Global Coffee Alliance partnership rose.

Foreign currency translation dampened some gains, though organic growth remained strong across both company and licensed stores.

The key takeaway is that Starbucks continued expanding its global retail presence while sales at existing stores also accelerated - driving steady high single-digit revenue expansion.

DCF/Free CashFlow

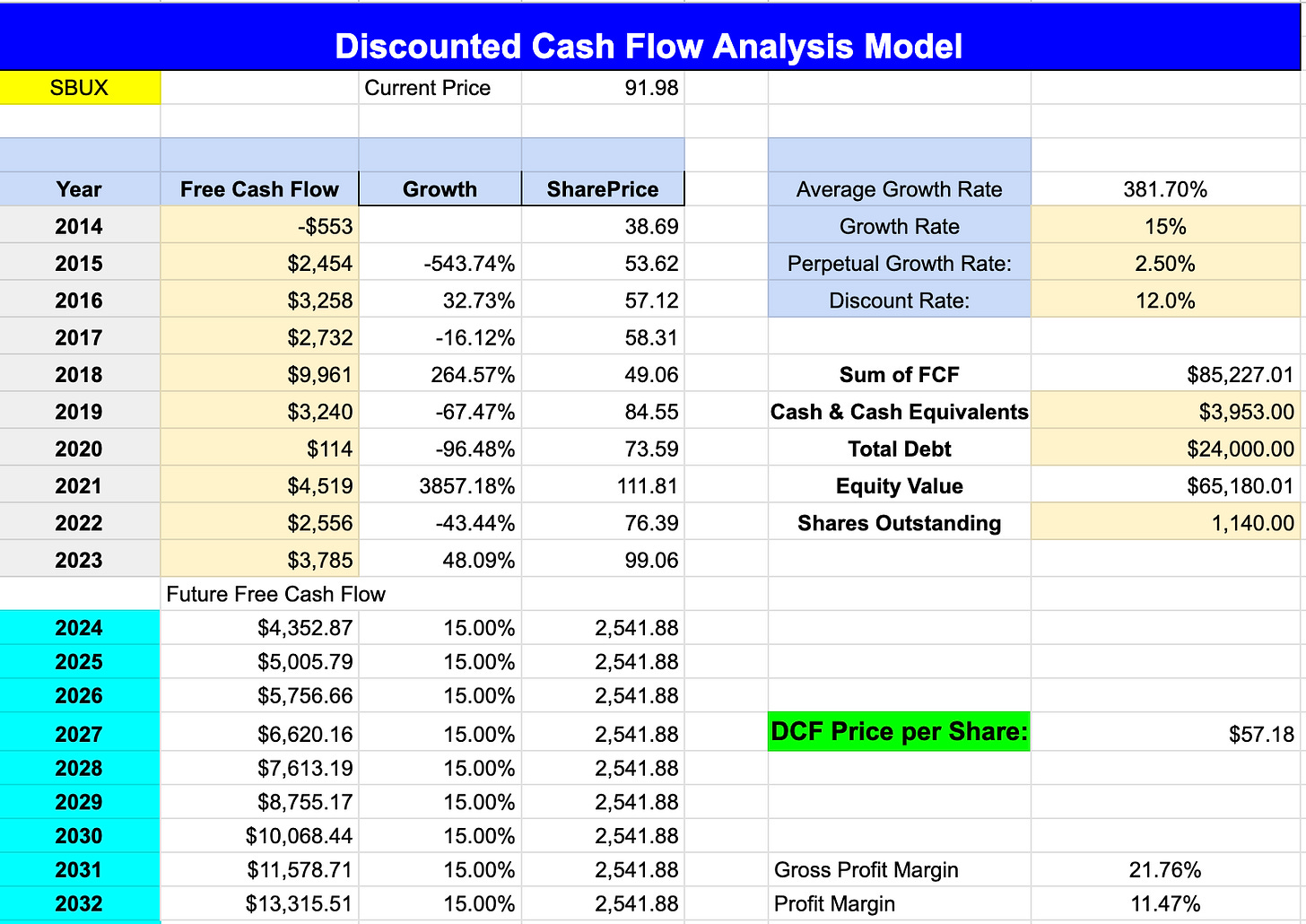

Using a growth rate of 15% and and a discount rate of 12% my target price is $57.18 which would equate to buying around 12 EV/EBITDA. Currently SBUX is at 16 EV/EBITDA.

Comparables

Comparing Starbucks with chipotle, DoorDash, McDonalds and Yum it does look like an attractive stock at current pricing. Trading at the lowest EV/EBITDA with the second highest ROIC.

ROIC

Starbucks' ROIC shows some major fluctuations over the past decade. After relatively stable ROIC around 30-35% from 2014-2017, it shot up to 45-46% in 2018 and 2019. This indicates Starbucks was generating more efficient returns from its capital investments during this period.

However, ROIC cratered in 2020 to just 8.8% amidst the COVID-19 pandemic's severe impacts. With many stores closed and sales plummeting, Starbucks saw its profitability plunge at a time it had recently made major investments in expanding store count, renovations, technology upgrades.

As conditions improved in 2021 and 2022, ROIC rebounded to 25.2% and 21.2% respectively. But these still remain well below pre-pandemic levels, suggesting Starbucks is facing some structural challenges recouping yields on capital spending.

Overall, Starbucks is doing a great job investing capital.

Summary

As an avid Starbucks customer myself, I really admire the company and think management has done an excellent job delivering generally superb capital efficiency over the years, as exemplified by ROIC averaging around 30%.

However for now, I plan to hold off on investing until Starbucks' stock price reflects a better entry point. But I will monitor closely for any significant corrections that bring the risk/reward proposition into a range I deem suitable to initiate a long term position.

If you crave more insightful articles uncovering hidden investment gems and market trends, subscribe now to stay ahead of the curve. Prepare for a journey that will elevate your investment strategies to new heights. Together, we'll explore the untapped potentials and untangle the enigmatic threads of the market's hidden treasures.