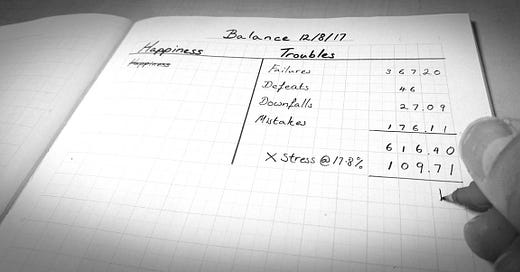

Reading A Balance Sheet 101

"Time is the friend of the wonderful company, the enemy of the mediocre." - Warren Buffett

Hacks to Reading a Balance Sheet

Understanding a balance sheet is crucial for investors, business owners, or anyone with an interest in finance.

While it might seem intimidating at first glance, breaking it down into its constituent parts can make the process much more manageable.

This guide aims to make you more comfortable with this important financial document.

Understand the Basics of a Balance Sheet

A balance sheet is a financial statement that shows what a company owns (assets), what it owes (liabilities), and the value of the ownership stake that the shareholders have (equity) at a specific point in time.

1.1 Assets

Assets are what a company owns and uses to operate the business. Assets are classified as either current or non-current.

Current Assets: These are assets that can be converted into cash within one year, such as cash, marketable securities, accounts receivable, and inventory.

Non-current Assets: These are long-term assets expected to provide value over a longer time frame, such as property, plant, equipment (PP&E), and intangible assets like patents or trademarks.

1.2 Liabilities

Liabilities represent what a company owes. Like assets, they are divided into current and non-current liabilities.

Current Liabilities: These are debts due within a year, including accounts payable, accrued expenses, and short-term debt.

Non-current Liabilities: These are debts or obligations due beyond one year, such as bonds payable, long-term loans, lease liabilities, and pension obligations.

1.3 Equity

Equity is the residual interest in the assets of an entity after deducting liabilities. In other words, equity represents ownership in the company and is equal to assets minus liabilities.

Hacks to Reading a Balance Sheet

2.1 Check Liquidity

A company's liquidity tells you its ability to meet short-term obligations. Two key ratios to look at are:

Current Ratio: This is calculated as current assets divided by current liabilities. A current ratio greater than one indicates that a company has enough assets to pay off its short-term liabilities.

Quick Ratio: This is calculated as (current assets - inventory) divided by current liabilities. This ratio excludes inventory, which may not be easily convertible to cash, offering a more stringent measure of liquidity.

2.2 Look at Debt Levels

A company's debt can give you insights into its financial health. You can look at the following ratios:

Debt-to-Equity Ratio: This is calculated as total liabilities divided by total equity. A higher ratio can indicate that a company has been aggressive in financing its growth with debt, which can result in volatile earnings.

Long-term Debt to Capitalization Ratio: This is calculated as long-term debt divided by long-term debt plus shareholders' equity. It shows the proportion of a company's capital provided by long-term debt.

2.3 Examine Efficiency

Inventory Turnover Ratio: This is calculated as cost of goods sold divided by average inventory for the period. A higher ratio indicates that a company manages its inventory effectively and sells its products quickly.

Accounts Receivable Turnover Ratio: This is calculated as net credit sales divided by average accounts receivable. A high ratio can indicate that a company collects its receivables quickly.

2.4 Evaluate Profitability

Return on Assets (ROA): This is calculated as net income divided by total assets. It shows how efficiently a company is using its assets to generate profits.

Return on Equity (ROE): This is calculated as net income divided by shareholders' equity. It measures the profitability of a company in relation to equity.

3. Understand Limitations

While the balance sheet can offer a lot of valuable information, it does have limitations. For instance, it doesn't account for intangibles that aren't listed, like brand value. Also, many of the values on the balance sheet are based on historical cost, not current market value.

Tips

Inter-Statement Relationships

Understand how the balance sheet relates to other financial statements. For instance, the net income from the income statement flows into retained earnings on the balance sheet.

Changes in balance sheet accounts are reflected in the cash flow statement.

Off-Balance Sheet Financing

Be aware that some companies may use off-balance sheet financing.

These are obligations that do not appear on the company's balance sheet due to technical accounting rules, but they still represent a liability for the company.

Operating leases were a common form of off-balance sheet financing until accounting rules changed to require their inclusion on the balance sheet.

Non-GAAP Adjustments

Some companies provide adjusted financial metrics that don't conform to Generally Accepted Accounting Principles (GAAP).

These can be useful for comparing across companies or industries where certain types of costs may be more prevalent, but they can also be abused to present a more favorable picture of the company's financial health.

Always compare the GAAP to the non-GAAP figures.

Footnotes and Management Discussion

Don't ignore the footnotes and the management discussion and analysis (MD&A) sections of the financial reports.

They can often provide valuable context and explanation for what you see on the balance sheet.

Industry-Specific Metrics

Some industries have specific balance sheet metrics that are especially important. For instance, for banks, metrics such as the Tier 1 capital ratio are critical.

For technology companies, capitalized research and development costs might be a key area to look at.

In summary, while the points above provide a good foundation for understanding a balance sheet, you'll want to continue expanding your knowledge as you delve deeper into financial analysis.

And remember, while analyzing a company's financials is important, it's just one aspect of the overall investment analysis process.

Wrapping up

We always value your thoughts, questions, and feedback. Your insights help us create content that best serves your needs and interests.

We are committed to providing you with relevant and insightful content, and your input is invaluable in helping us achieve this goal.

If you know someone - be it a friend, family member, or colleague - who might benefit from our newsletter, we encourage you to share it with them.

Best regards,

Value Vultures