How to Identify Winning Stocks: Unveiling the Secret Power of ROIC

"The big money is not in the buying and selling... but in the waiting." Charlie Munger

Today's edition of Value Vulture is dedicated to a crucial financial metric: Return on Invested Capital (ROIC). Our goal is to provide a clear and educational insight into this concept, essential for making informed investment decisions.

What is ROIC?

ROIC stands for Return on Invested Capital. It measures a company's efficiency in using its capital to generate profits. In simple terms, it's a ratio that compares the net income a company generates to the capital it has invested in its business. This is a critical metric because it tells us how well a company is using its resources to make money.

Why Is ROIC Important?

Understanding ROIC is vital because it provides insight into a company's operational efficiency and its ability to create value for shareholders. A higher ROIC indicates a company is generating more income per dollar of capital invested, signifying better management efficiency and potentially a more robust competitive advantage.

Warren Buffett's Perspective on ROIC

Warren Buffett, emphasizes the importance of ROIC. He believes that companies with a high ROIC are often those with durable competitive advantages. These companies can sustain higher earnings and, therefore, are more likely to deliver better long-term investment returns.

ROIC and Company Performance

Consider two companies in the same industry: one with a high ROIC and the other with a low ROIC. The company with the higher ROIC is generally using its capital more effectively to generate profit. This efficiency can often translate into better financial health and potentially higher stock prices over time even if the company with a lower ROIC is priced lower at the time.

ROIC's Role in Predicting Future Returns

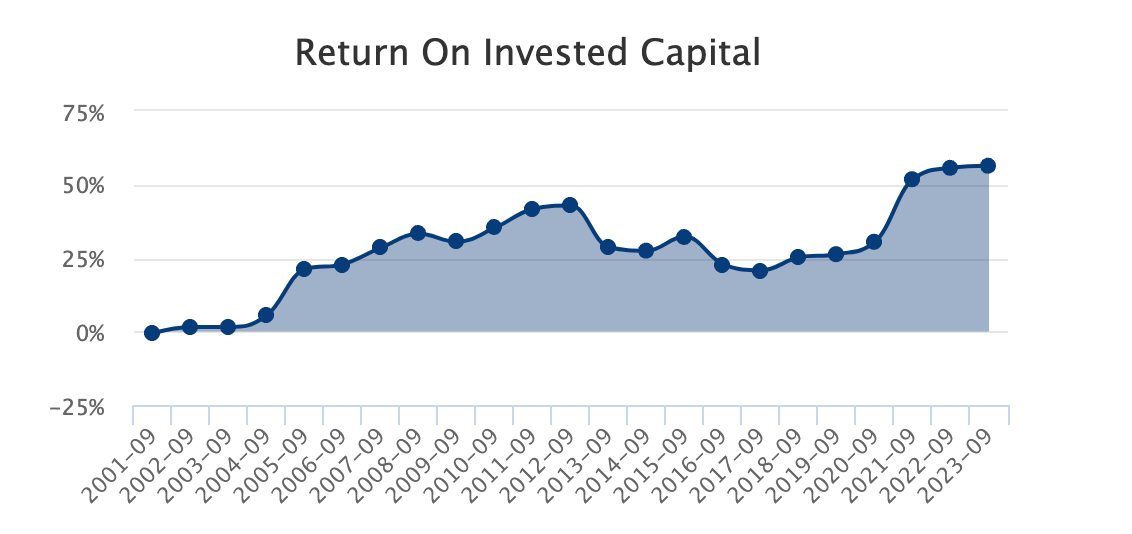

A company's ROIC can be a good indication of its future earnings potential. A consistent track record of high ROIC suggests that the company has a successful business model and is likely to continue generating above-average profits. This is crucial for investors looking for companies with sustainable growth prospects. Although no metric can predict the future and its possible a company goes from having a high ROIC one year to a low ROIC the next year.

Applying ROIC in Value Investing

As value investors, our focus is on finding undervalued stocks with strong fundamentals. A high ROIC can be an indicator of a fundamentally strong company. By identifying these companies, investors can potentially find stocks that offer both value and growth.

What is a good ROIC ratio?

A "good" Return on Invested Capital (ROIC) ratio can vary depending on the industry and economic context, but generally, a ROIC that is higher than a company's cost of capital is considered good. This indicates that the company is creating value, as it's earning more on its investments than it costs to fund those investments.

As a benchmark:

Above the Cost of Capital: If a company's ROIC is above its weighted average cost of capital (WACC), it's generally considered good. The WACC represents the average rate a company is expected to pay on its equity and debt.

Comparison with Industry Averages: It's also useful to compare a company's ROIC with the average ROIC of its industry. A good ROIC is one that is consistently higher than the industry average, indicating that the company is more efficient than its peers at using capital to generate profits.

ROIC Over 15-20%: Some investors, like Warren Buffett, look for companies with an ROIC of 15-20% or higher, as this can indicate a strong competitive advantage and efficient use of capital.

Long-Term Perspective: A consistently high ROIC over a period of years is generally more indicative of a good investment than a high ROIC in a single year, as it shows sustained efficiency and profitability.

It's important to consider ROIC in conjunction with other financial metrics and qualitative factors like management quality, market position, and industry trends for a comprehensive evaluation of a company's investment potential.

How is ROIC calculated?

Return on Invested Capital (ROIC) is calculated using the following formula:

Here's how each component is determined:

Net Operating Profit After Taxes (NOPAT): NOPAT is the profit a company would make if it had no debt and held only operational assets. It is calculated by adjusting the operating income for taxes:

NOPAT=Operating Income×(1−Tax Rate)

Operating income is also known as Earnings Before Interest and Taxes (EBIT).

Invested Capital: Invested capital can be figured out in two main ways: by looking at a company's assets or by examining its mix of debt and equity (how it's financed). To get a clearer picture of how the company really uses its resources, it's often more insightful to focus on its assets.

Here's a simpler breakdown of calculating invested capital using the company's assets:

Start with Working Capital: First, figure out the company's working capital. This is what the company uses for its day-to-day operations. You calculate it by subtracting the company's non-interest-bearing current liabilities (like bills it needs to pay soon, but isn't paying interest on) from its current assets (things it owns that can be quickly turned into cash).

For example, if a company has $2 billion in things it can quickly sell for cash (current assets) and owes $1 billion in bills that don't have interest (non-interest-bearing liabilities), its working capital is $1 billion ($2 billion - $1 billion).

Add Other Important Assets: To this working capital, add the value of long-term assets like property, factories (plants and equipment), any goodwill (like brand value or customer relationships), and other assets the company uses for operations.

Let's say our company has $2.5 billion in property and factories, $500 million in brand value, and $1 billion in other useful assets. You would add these to the $1 billion working capital.

Calculate Invested Capital: Add all these up to get the invested capital. In our example, it would be $5 billion.

Conclusion: The Importance of ROIC in Value Investing

In summary, ROIC is a fundamental metric that helps investors gauge a company's efficiency and profitability relative to its capital. It aligns with the principles of value investing, emphasizing the importance of company fundamentals in investment decision-making. Understanding and using ROIC can aid investors in identifying companies that are not just profitable but also efficient and capable of sustaining growth.

Wrapping up

We always value your thoughts, questions, and feedback. Your insights help us create content that best serves your needs and interests.

We are committed to providing you with relevant and insightful content, and your input is invaluable in helping us achieve this goal.

If you know someone - be it a friend, family member, or colleague - who might benefit from our newsletter, we encourage you to share it with them.

Best regards,

Value Vultures