HIMS Stock: The Next Big Healthcare Giant or a Ticking Time Bomb?

"Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1." - Warren Buffett

HIMS Stock: A Future Healthcare Titan or a Risky Bet on Hype? Investors are buzzing about HIMS, but is it a hidden gem poised for massive growth—or a bubble waiting to burst? With soaring revenue and a disruptive business model, HIMS is shaking up the healthcare industry—but is it built to last? Some see it as the future of digital health, while others warn of hidden risks—let’s break down the facts and uncover the real story.

The Secret Behind HIMS’ Explosive Growth

Hims & Hers Health isn’t just another healthcare company—it’s rewriting the rules of the industry. While traditional healthcare moves at a snail’s pace, HIMS is sprinting ahead, using a tech-first, direct-to-consumer approach to dominate telehealth.

But how exactly did they go from a niche startup selling hair loss treatments to a billion-dollar disruptor in multiple healthcare markets? And more importantly—can they keep this momentum going?

A Business Model That Prints Money 💰

Most healthcare companies rely on one-time transactions—a doctor visit here, a prescription refill there. But HIMS does things differently. They operate on a subscription model, meaning customers don’t just buy once—they keep coming back month after month.

Why is this so powerful? Because recurring revenue is predictable, high-margin, and scalable. The longer a customer stays subscribed, the more profitable they become. And HIMS has been exceptional at keeping customers on board, thanks to a seamless, hassle-free experience that makes healthcare feel effortless.

How HIMS is Turning Customers Into Lifelong Subscribers

HIMS’ real genius isn’t just getting customers—it’s expanding their lifetime value.

Most people come in for a single treatment—maybe hair loss, ED meds, or weight loss drugs. But once they’re in, HIMS makes it incredibly easy to add more services.

👨⚕️ Already using HIMS for hair loss? Try their mental health therapy.

🩺 Taking ED medication? Why not add a primary care consultation?

💊 Losing weight with GLP-1 drugs? Check out HIMS’ skincare treatments too.

Every new service increases the customer’s lifetime value, and the more services they use, the harder it becomes to leave.

The Marketing Machine Fueling HIMS’ Rise

HIMS has mastered direct-to-consumer (DTC) marketing, bypassing traditional healthcare gatekeepers like doctors and insurance companies to sell directly to customers online. This allows them to control pricing, branding, and customer relationships, creating higher margins and a seamless user experience. Their aggressive digital advertising strategy leverages precision-targeted paid ads, influencer partnerships, and social media dominance to acquire customers at scale.

Unlike traditional healthcare brands, HIMS makes treatments feel modern, accessible, and stigma-free, which improves conversion rates and customer retention. More importantly, their subscription model ensures long-term revenue, meaning every acquired customer has the potential to generate years of recurring cash flow. However, as competition increases, maintaining a low customer acquisition cost (CAC) will be crucial for sustaining profitability. Investors should watch whether HIMS can scale efficiently without overspending on marketing, as this will determine if their rapid growth translates into long-term success.

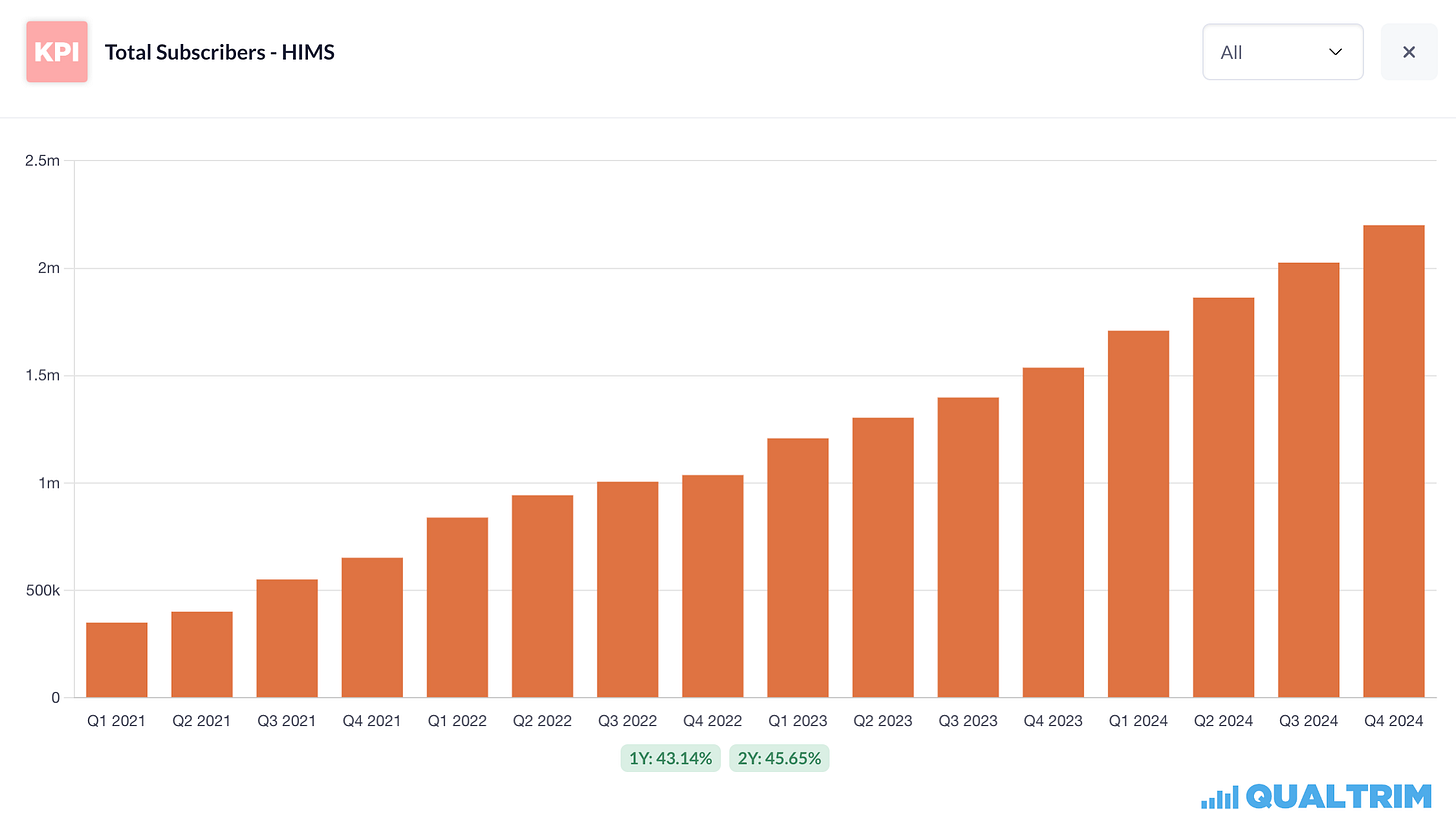

Subscriber Growth is Surging—But Can It Keep Up?

HIMS has seen explosive subscriber growth, surpassing 1.5 million paying customers and continuing to expand at a rapid pace. This growth is fueled by their recurring revenue model, where customers sign up for ongoing treatments rather than one-time purchases, creating long-term revenue visibility and high customer lifetime value (LTV). A key driver of this expansion is category diversification—many customers start with one treatment (like hair loss or ED meds) and later add services like mental health, skincare, or weight loss. However, sustaining this momentum will depend on keeping customer acquisition costs (CAC) under control, especially as competition in telehealth intensifies. If HIMS can continue to acquire customers efficiently while increasing retention and upsell rates, they could see subscriber numbers double in the next few years. Investors should monitor churn rates, CAC trends, and customer LTV growth to assess whether HIMS can maintain its strong subscriber trajectory without sacrificing profitability.

Revenue is Soaring—But Will Profits Follow?

HIMS has been growing revenue at an exceptional pace, surpassing $1 billion in annual sales with expectations to sustain 25-30% annual growth in the coming years. This growth is driven by a rapidly expanding subscriber base, strong retention rates, and higher revenue per user as customers add more treatments over time. However, revenue alone doesn’t guarantee profitability—the key question is whether HIMS can scale efficiently while improving margins. While they recently achieved positive adjusted EBITDA, true profitability will depend on reducing customer acquisition costs (CAC), increasing gross margins, and leveraging operating efficiencies. The biggest risk is that high marketing spend, regulatory changes, or rising competition could pressure margins and delay profitability. Investors should focus on gross margin trends, CAC efficiency, and EBITDA progression to determine whether HIMS can convert its strong revenue growth into sustainable long-term profits.

The Biggest Risks That Could Derail HIMS’ Success

Hims & Hers Health (HIMS) has built a strong brand in telehealth, but several key risks could threaten its long-term success. Regulatory uncertainty is a major concern, as telemedicine laws are evolving, and tighter restrictions could impact how Hims operates, especially in prescription-based treatments. Customer acquisition costs (CAC) are another risk—while Hims has successfully grown through digital marketing, rising ad costs or platform changes (like Apple's privacy updates) could hurt profitability. Retention and lifetime value (LTV) are critical metrics—if customers don’t stick with subscriptions long-term, Hims could struggle to maintain strong unit economics. Competition from both legacy healthcare providers and new direct-to-consumer (DTC) entrants is intensifying, which could pressure margins and slow growth. Supply chain and fulfillment risks also exist, as the company relies on third parties for manufacturing and pharmacy fulfillment, making it vulnerable to disruptions. Lastly, profitability remains uncertain—despite strong revenue growth, Hims is still working toward sustained net income, and any missteps in scaling could prolong losses. Investors should weigh these risks carefully against Hims' growth potential in the telehealth space.

Is HIMS Overpriced or a Hidden Bargain?

Hims & Hers Health (HIMS) trades at a high price-to-earnings (P/E) ratio, which may initially suggest it's overvalued, but high-growth companies often justify premium valuations. The key question for investors is whether Hims can sustain its rapid revenue expansion and improve profitability to grow into its valuation. With a strong direct-to-consumer brand and a massive addressable market in telehealth, the company has the potential to scale significantly, which could make today’s price look cheap in hindsight. However, execution risks remain—Hims must continue reducing customer acquisition costs, increasing retention, and expanding its product offerings to maintain growth. If the company delivers on these fronts, its valuation could normalize over time as earnings catch up. But if growth slows or margins don’t improve, today’s high multiple could lead to disappointing long-term returns. Investors should weigh the risk-reward balance carefully, understanding that Hims is priced for high expectations but also has the potential to outperform if it executes well.

The Final Verdict: Is HIMS Stock Worth the Risk?

Hims & Hers Health (HIMS) presents a compelling risk-reward opportunity for investors willing to bet on high-growth companies. While the stock trades at a premium valuation, its rapid revenue expansion and improving margins suggest that it could grow into its valuation over time. The company has successfully disrupted traditional healthcare with a scalable direct-to-consumer model, and its expansion into new categories like weight loss and mental health could drive further growth. Retention rates and customer acquisition costs remain key metrics to watch, but if Hims continues executing—improving profitability while sustaining strong top-line growth—it has the potential to justify its high multiple. While risks exist, particularly with competition, regulatory hurdles, and execution, the upside is significant if the company continues its trajectory. Given its strong market position and expanding addressable market, HIMS appears to be worth the risk for long-term investors who believe in the telehealth trend and are comfortable with volatility.