SECRET Strategies of Warren Buffett and Seth Klarman Turn Your Investments into a Goldmine!

"The stock market is designed to transfer money from the active to the patient." - Warren Buffett

As we wrap up the week, we're excited to dive deep into a treasure trove of insights, analyses, and value opportunities just for you.

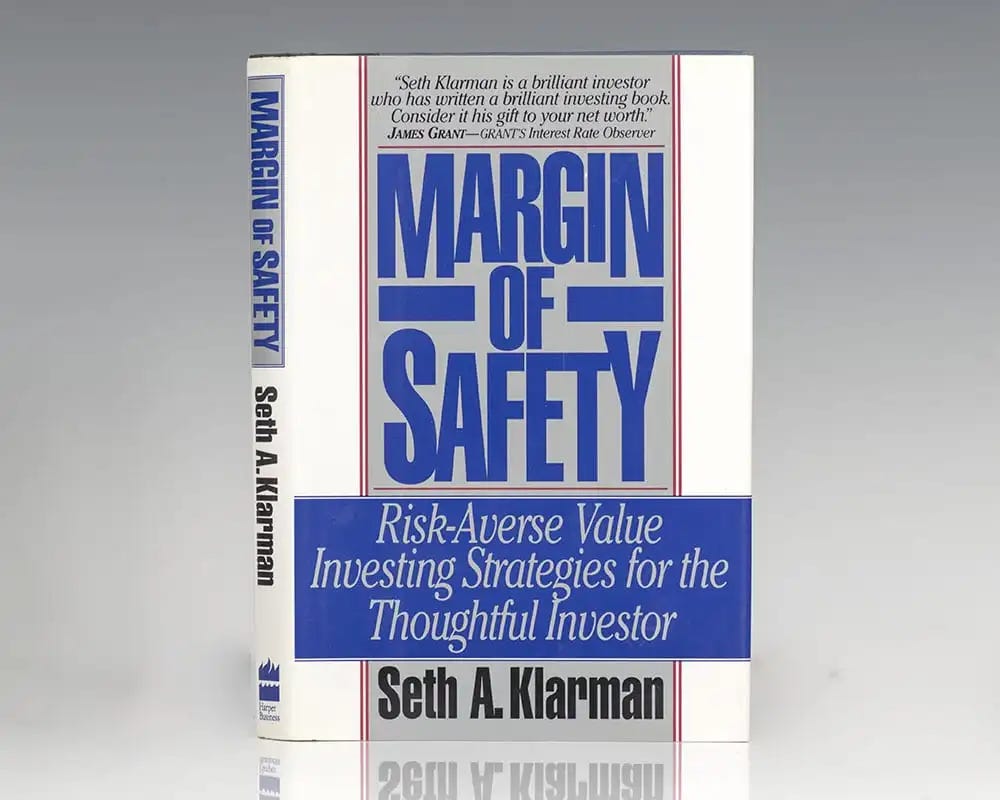

Book Review

"Margin of Safety" by Seth Klarman

"Margin of Safety," penned by renowned value investor Seth Klarman, is a seminal work that presents a compelling case for value investing. It remains an invaluable resource for understanding the philosophy and principles of this investment strategy.

Klarman, the founder of the Baupost Group, underlines the central concept of a 'margin of safety', which entails buying securities at prices significantly below their intrinsic value. This buffer provides a safeguard against unforeseen events, inaccuracies in intrinsic value estimation, and market downturns.

Key takeaways include:

Risk-Averse Investing: Klarman emphasizes the importance of capital preservation over capital appreciation, suggesting investors to focus on downside protection.

The Psychology of Investing: The book delves into investor behavior, illustrating how emotion and herd mentality can lead to financial missteps. It encourages a rational, independent-thinking approach.

Investment Process: Klarman advocates for a thorough and diligent research process before making an investment, focusing on long-term fundamentals rather than short-term market trends.

Opportunistic Investing: The author encourages investors to be flexible and seize opportunities in various sectors and security types, especially in distressed markets.

Despite being out of print and often hard to find, "Margin of Safety" is a worthy read for any serious value investor. Its timeless wisdom and practical insights provide a solid foundation for developing a risk-averse, value-oriented investment philosophy.

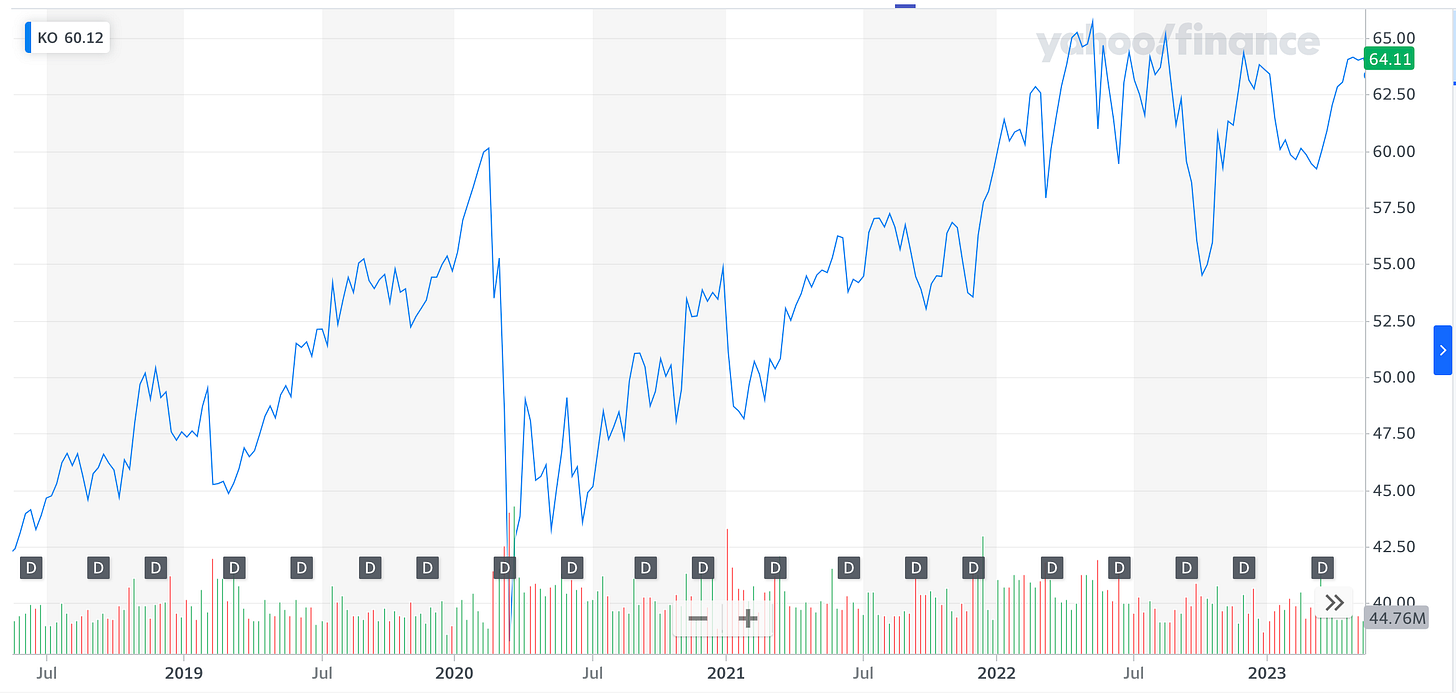

Company Breakdown

Ticker: The Coca-Cola Company (KO)

Price: $64.11

P/E Ratio: 28.12

Market Cap 277.249B

Summary:

The Coca-Cola Company is a multinational beverage corporation based in Atlanta, Georgia. Founded in 1886, it's one of the largest and most recognizable drink manufacturers in the world.

The Coca-Cola Company primarily generates revenue through the manufacture, marketing, and sale of nonalcoholic beverages. This includes a vast portfolio of both carbonated and non-carbonated drinks. Some of the company's most popular brands include Coca-Cola, Diet Coke, Coca-Cola Zero Sugar, Fanta, Sprite, Powerade, Minute Maid, and Dasani.

Coca-Cola operates under a franchised distribution system, where it sells concentrate and syrup to bottling partners who process, package, and distribute the final products to retail outlets. This business model allows Coca-Cola to significantly reduce its capital requirements and focus on its core competencies: brand development and beverage innovation.

The company also earns revenue from the sale of its finished product to customers in North America and from various licensing arrangements. Coca-Cola's products are sold in over 200 countries, providing a global revenue stream.

Despite challenges such as changing consumer preferences towards healthier beverages, The Coca-Cola Company continues to adapt its product mix and maintain a strong market presence due to its robust brand portfolio, extensive distribution network, and strong marketing capabilities.

The Opportunity

Brand Strength: Coca-Cola is one of the most recognized and valuable brands in the world, ensuring consistent consumer demand.

Diversified Portfolio: Coca-Cola has a diversified beverage portfolio that includes over 500 brands, allowing it to cater to a broad range of consumer tastes and preferences. This diversification reduces dependence on a single product and mitigates risks.

Global Presence: Coca-Cola products are sold in over 200 countries, providing a stable, global revenue stream and opportunities for growth in emerging markets.

Robust Distribution Network: The company’s vast and efficient distribution network allows it to reach consumers in even the most remote corners of the world, giving it a significant advantage over its competitors.

Adaptability: Coca-Cola has shown an ability to adapt to changing consumer preferences, expanding its portfolio to include healthier options like juices, teas, and mineral water. This adaptability will be key to maintaining its market position in the long term.

Investor Spotlight

Howard Marks is an American investor and writer, known for his insightful assessments of market opportunities and risks. He co-founded Oaktree Capital Management, a Los Angeles-based investment firm, in 1995. Prior to that, he led the groups at The TCW Group, Inc. responsible for investments in distressed debt, high yield bonds, and convertible securities.

Marks is renowned in the investment community for his "Oaktree Memos" to clients, where he details investment strategies and insights. His investment philosophy emphasizes risk control, consistency, and market inefficiencies. He's also the author of two books on investing: "The Most Important Thing Illuminated: Uncommon Sense for the Thoughtful Investor" and "Mastering the Market Cycle: Getting the Odds on Your Side." Both books are highly regarded in the investment community.

He is widely recognized for his expertise in distressed securities and his record of generating consistent, above-average returns for his clients, while maintaining a strong focus on risk management.

Investing Tips

One of Howard Marks' most well-known investing tips is the idea of "second-level thinking." Marks encourages investors to go beyond the first level of thinking, which is simplistic and superficial, and move to the second level, which is deeper and more complex.

In his own words: "First-level thinkers look for simple formulas and easy answers. Second-level thinkers know that success in investing is the antithesis of simple...The problem is that extraordinary performance comes only from correct non-consensus forecasts, but non-consensus forecasts are hard to make, hard to make correctly and hard to act on."

This tip encourages investors to challenge prevailing market wisdom, think deeply and critically about investment opportunities, and consider all potential outcomes, not just the most obvious or likely ones.

Warren Buffett Wisdom

We always value your thoughts, questions, and feedback. Your insights help us create content that best serves your needs and interests. Please don't hesitate to reach out to us with any comments, questions, or even topics you'd like to see covered in future editions of our newsletter.

We are committed to providing you with relevant and insightful content, and your input is invaluable in helping us achieve this goal. Remember, there's no such thing as a silly question, and your feedback is always appreciated.

If you know someone - be it a friend, family member, or colleague - who might benefit from our newsletter, we encourage you to share it with them. Our goal is to create a community of informed and engaged investors, and every new reader helps us to do just that.

Thank you for your ongoing support and involvement. Your engagement is what makes this community so unique and valuable!

Best regards,

Value Vultures